What are Bracket Orders ? How do they work ?

Bracket Order

Bracket order is a type of order in which you can enter into a new position along with a target and a stop-loss order together. As soon as the main order is completed system will place the remaining two orders (SL and Target) automatically. Likewise, as soon as one of the pending orders from SL and target will be completed, another order will be canceled automatically.

Watch video on YouTube >

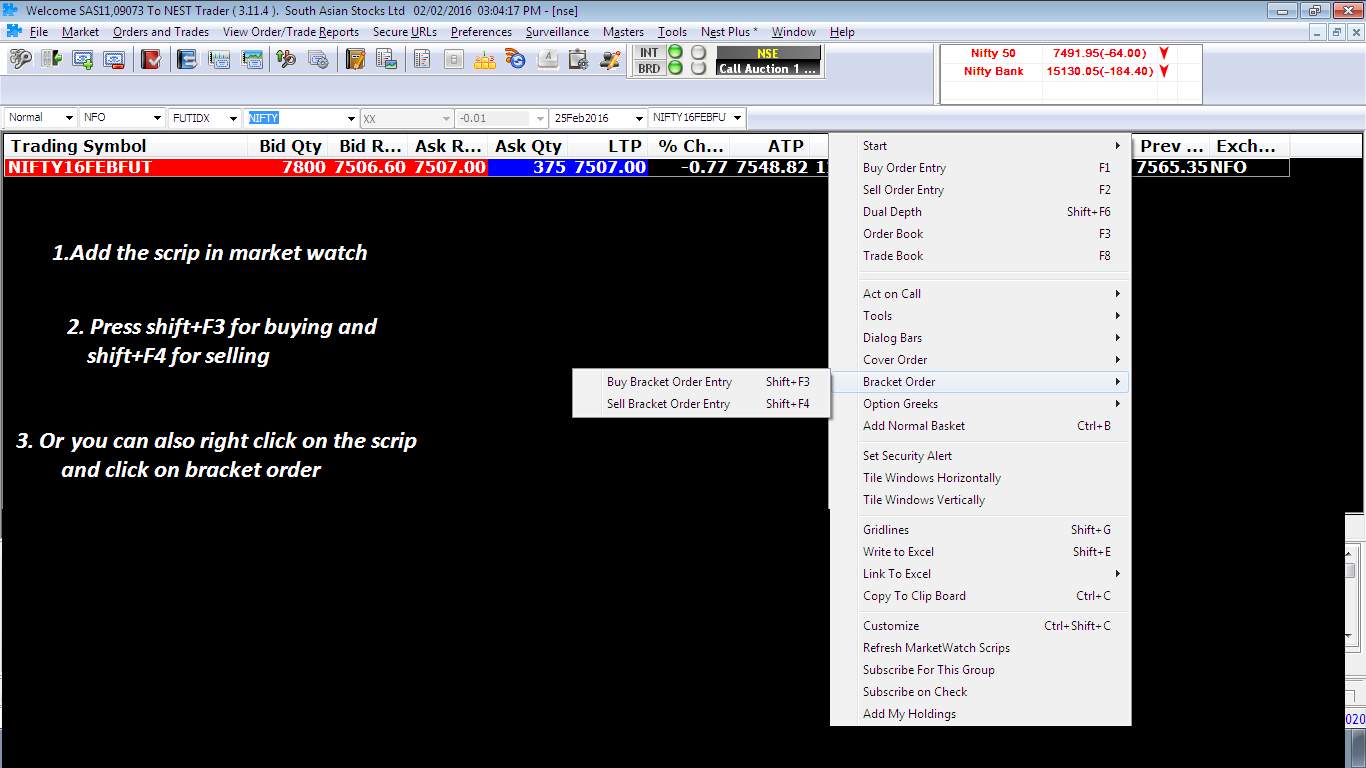

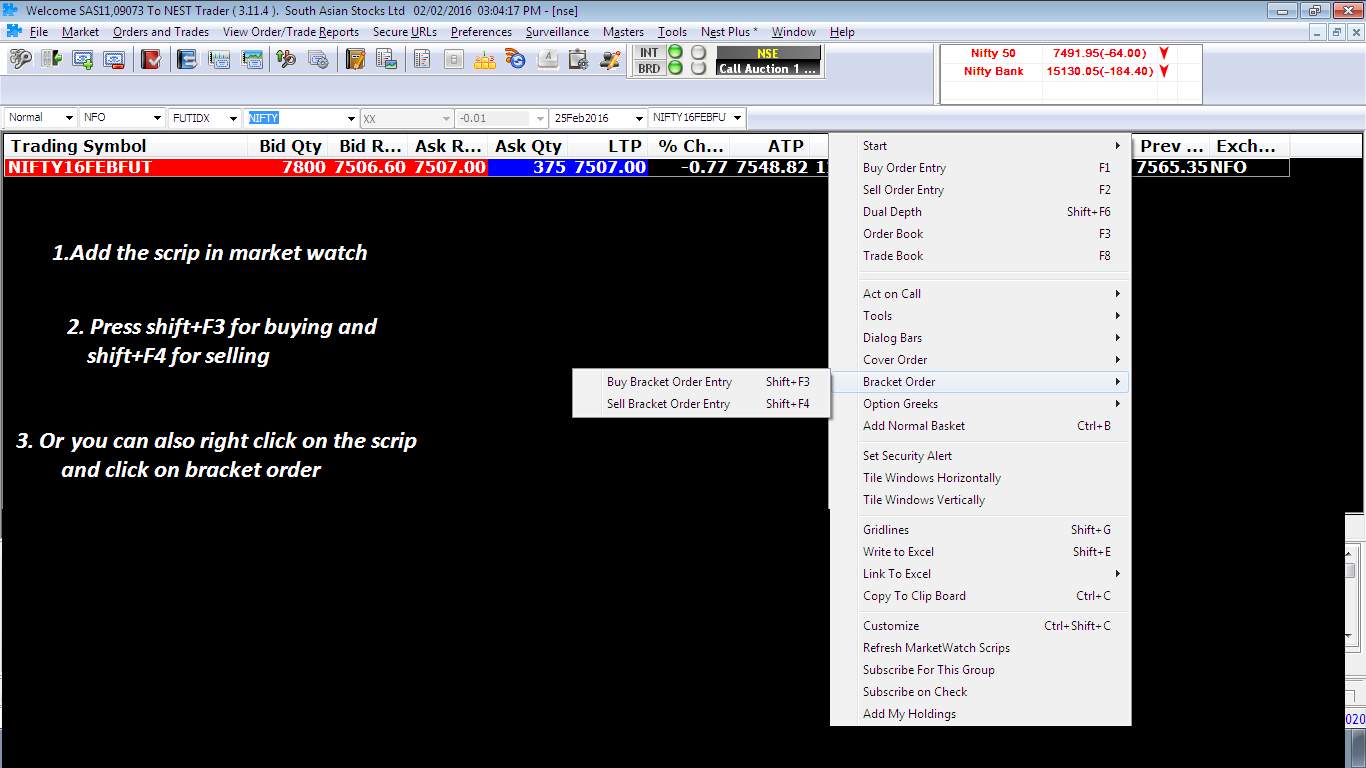

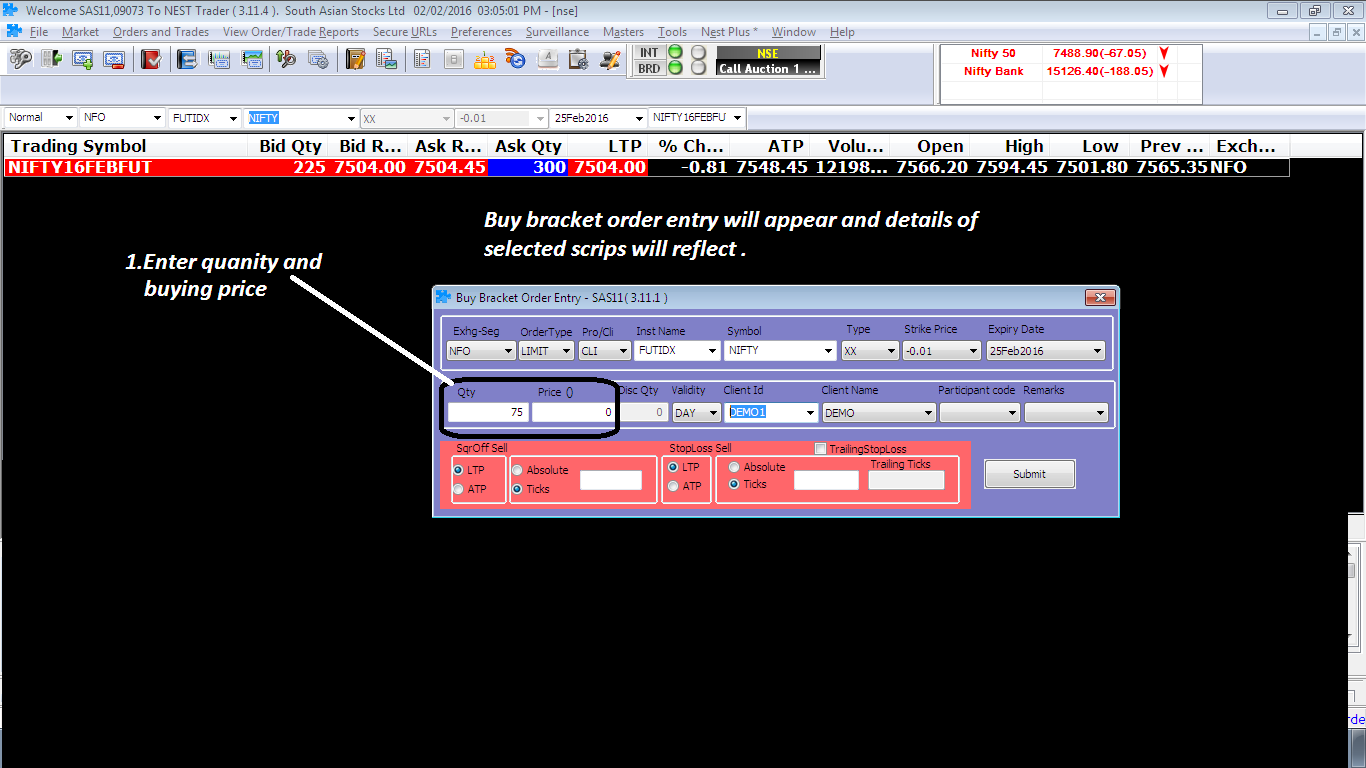

Placing a Bracket order:

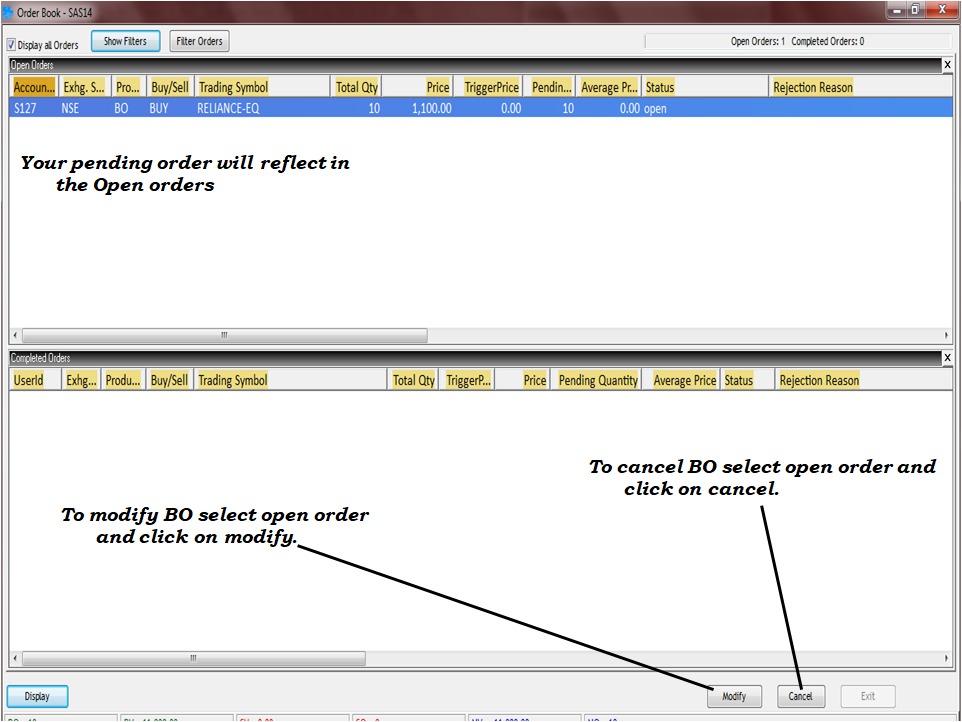

- Buy Order Entry - Shift + F3

- Sell order Entry - Shift + F4

- Bracket order square off - F3 (order book) >> Select pending order >> EXIT.

- Or Right Click on the scrip to choose Bracket order entry.

Flow Process

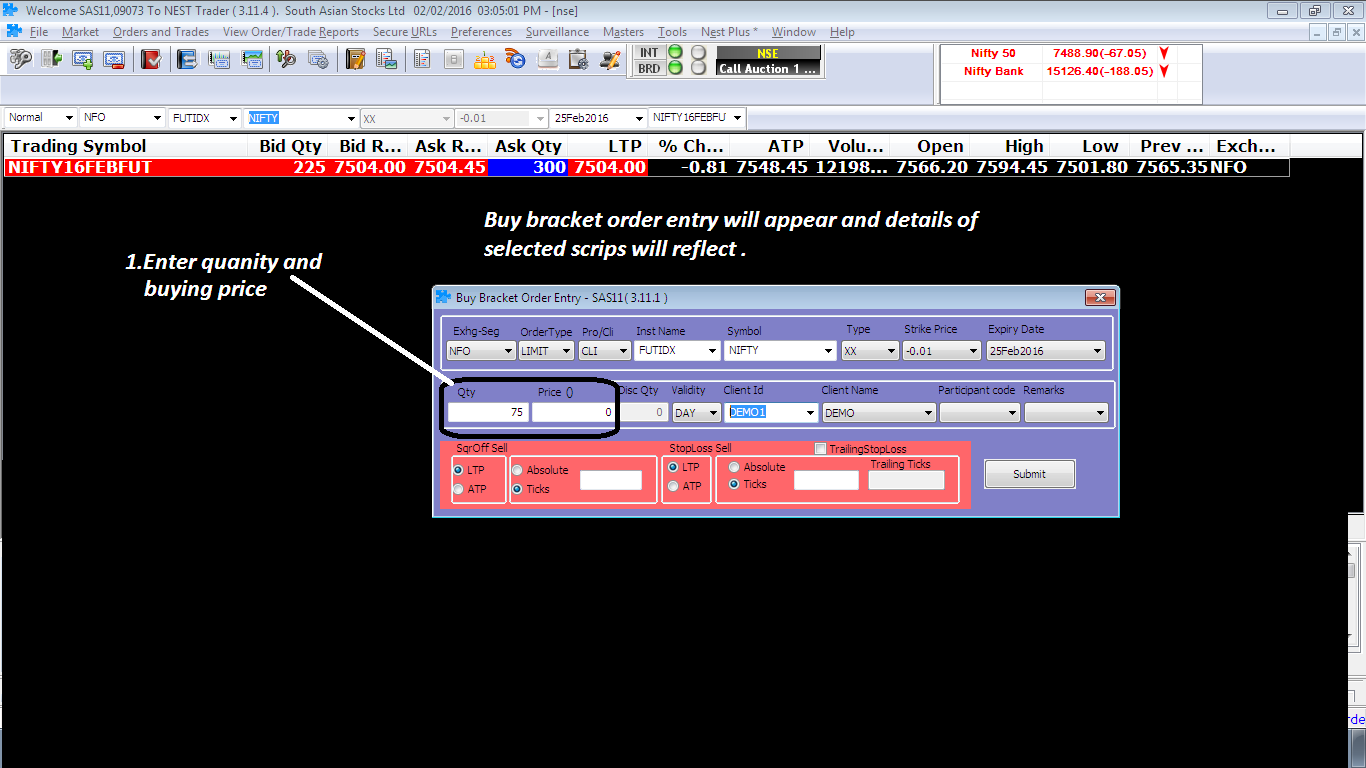

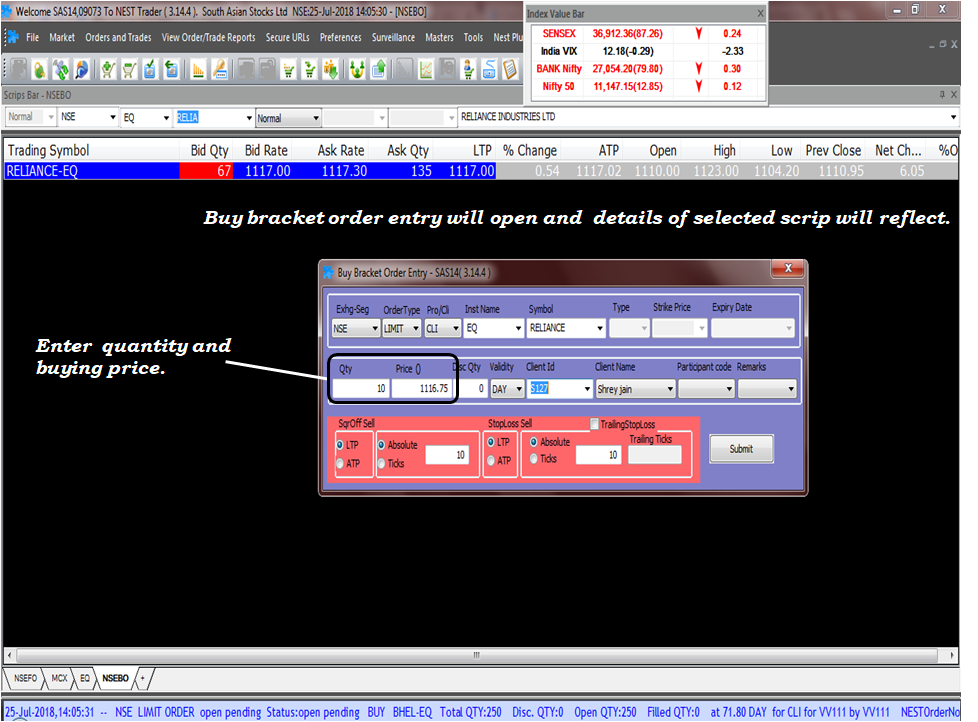

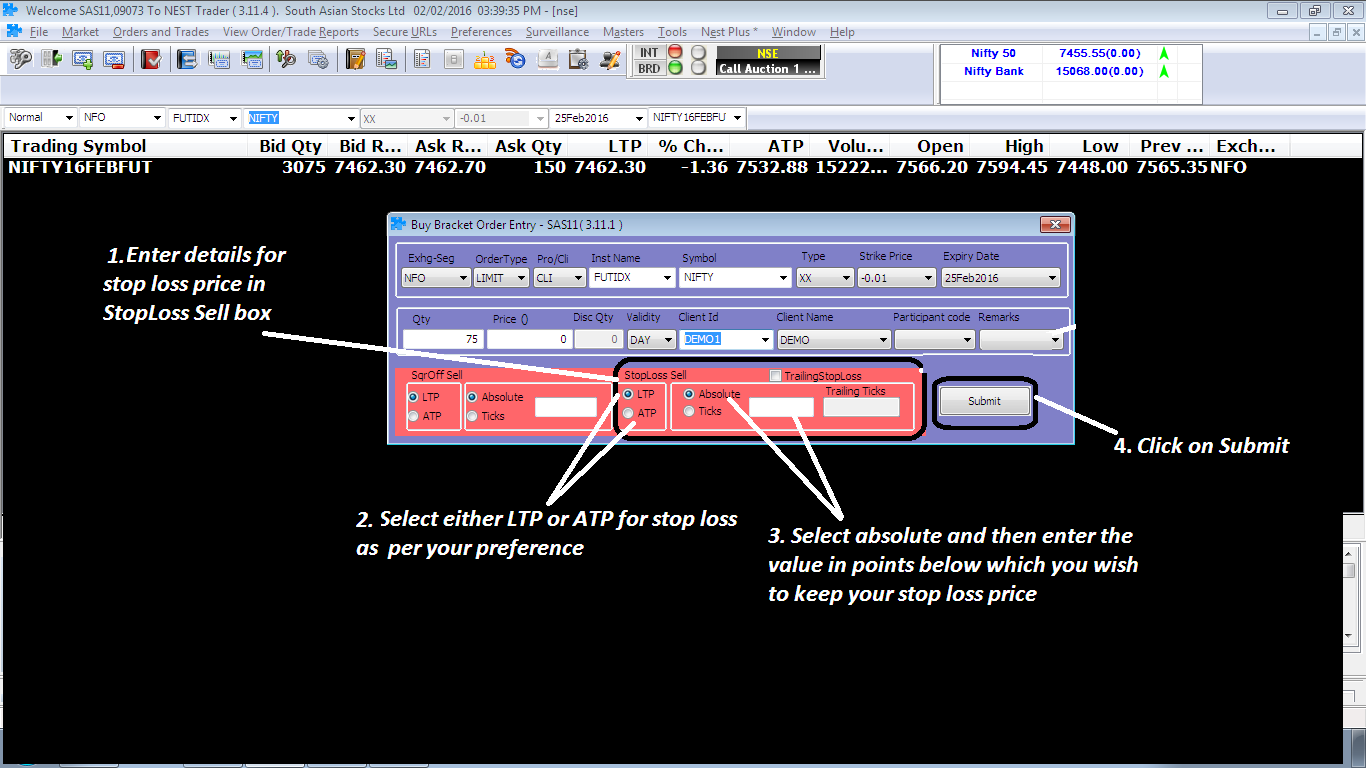

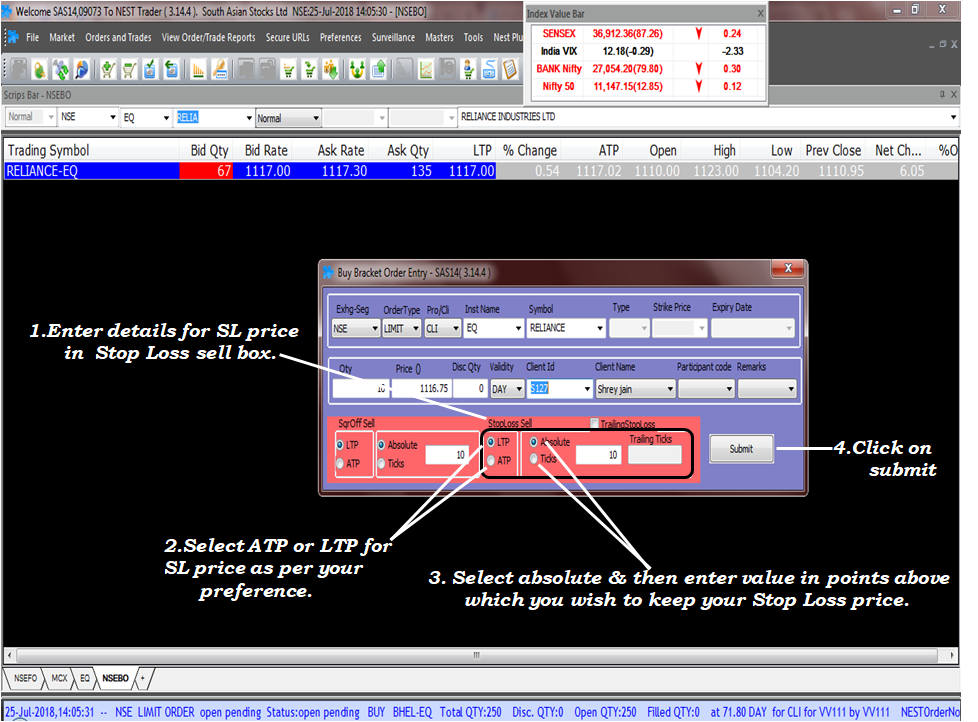

1. Place a limit order, to enter a position.

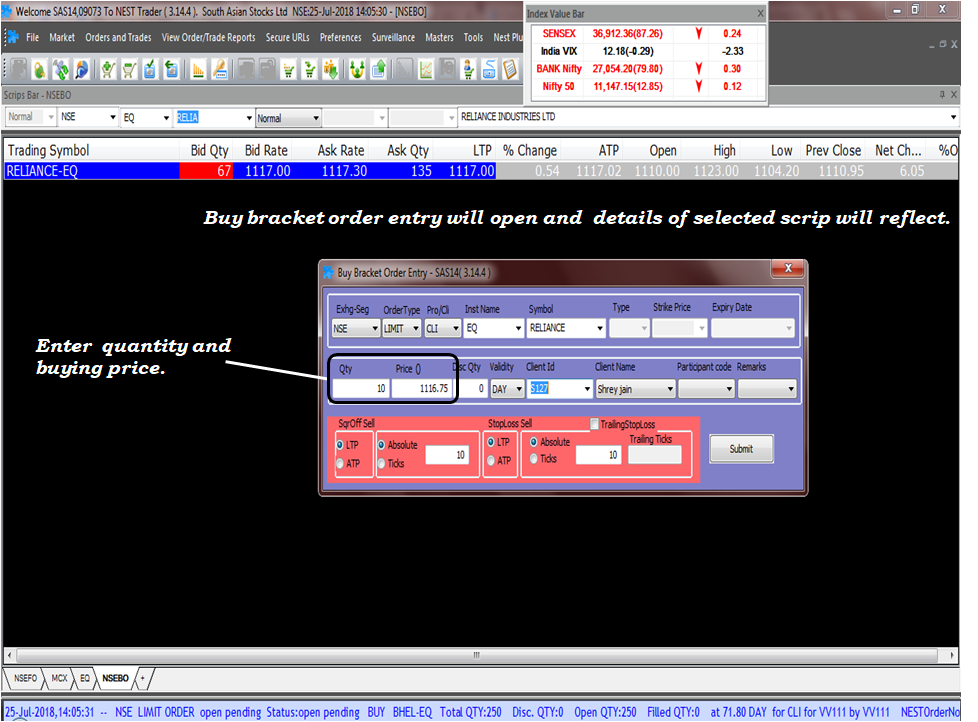

EQ Segment

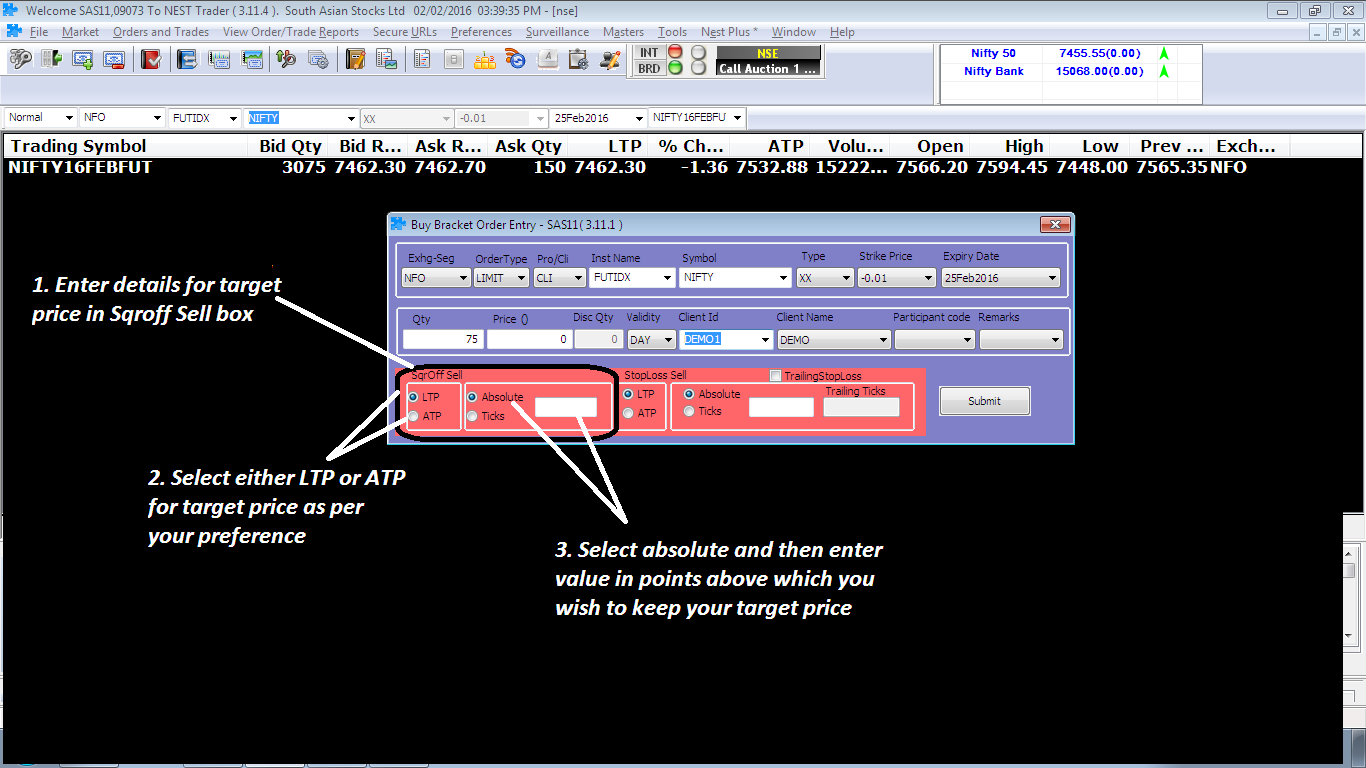

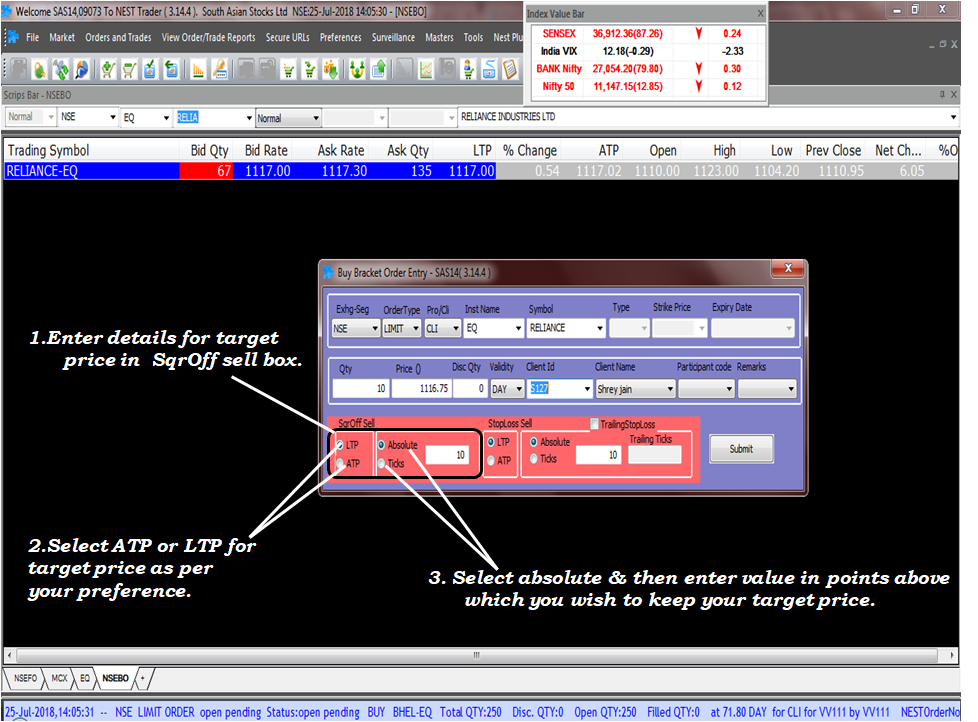

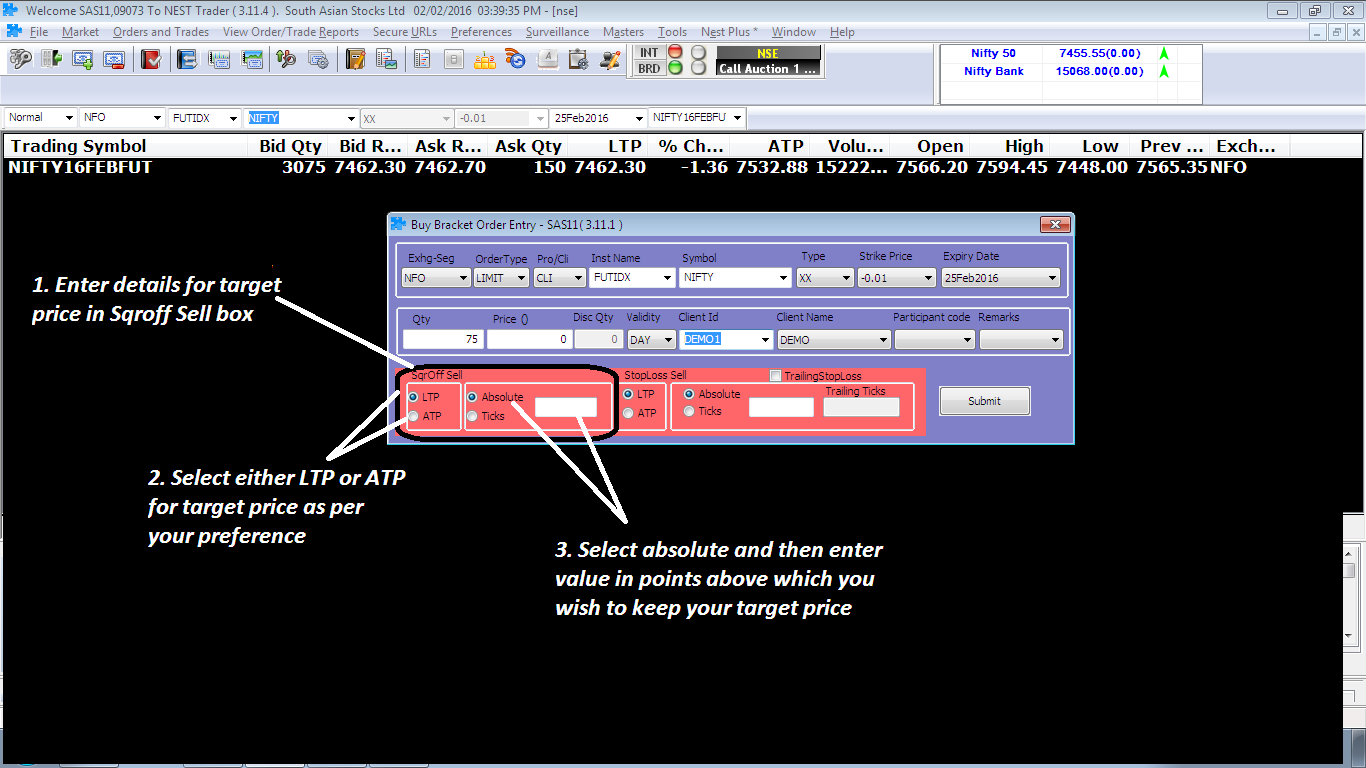

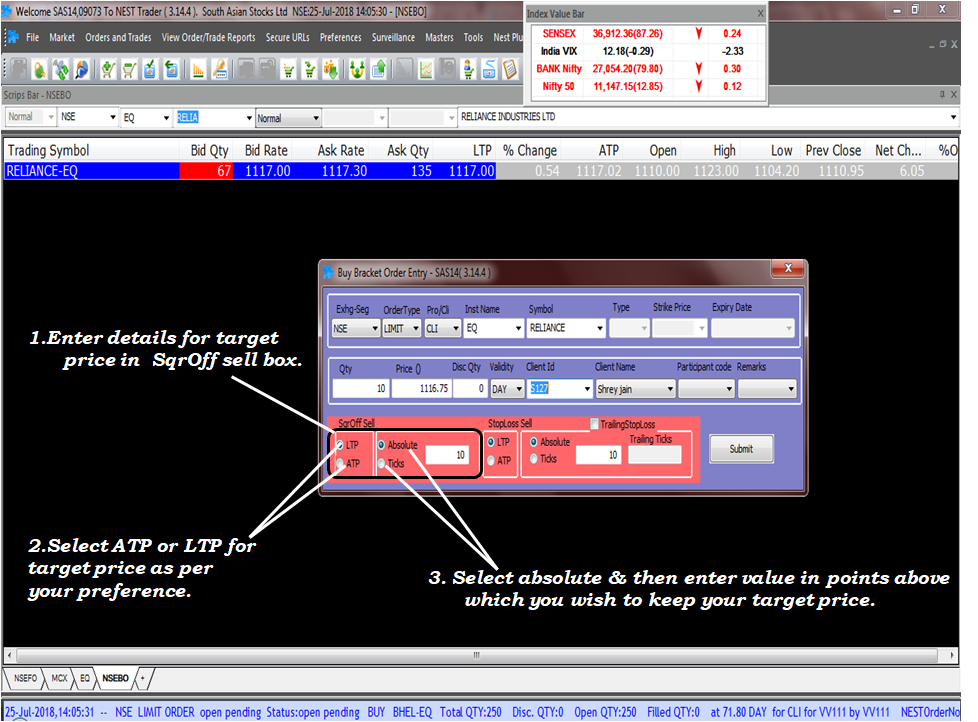

2. Place a Target Price / Square Off Price by choosing LTP / ATP as per your reference in the first column and absolute / tick in the second column.

EQ Segment

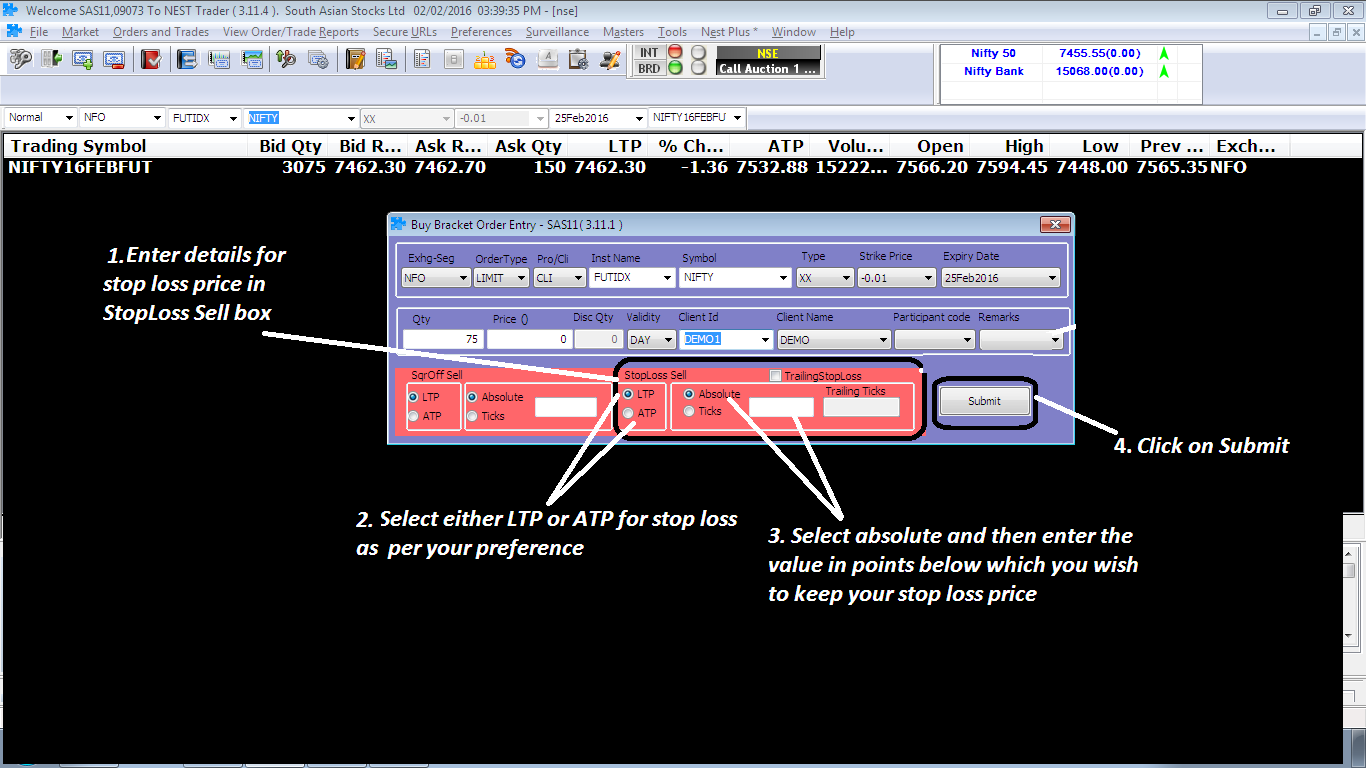

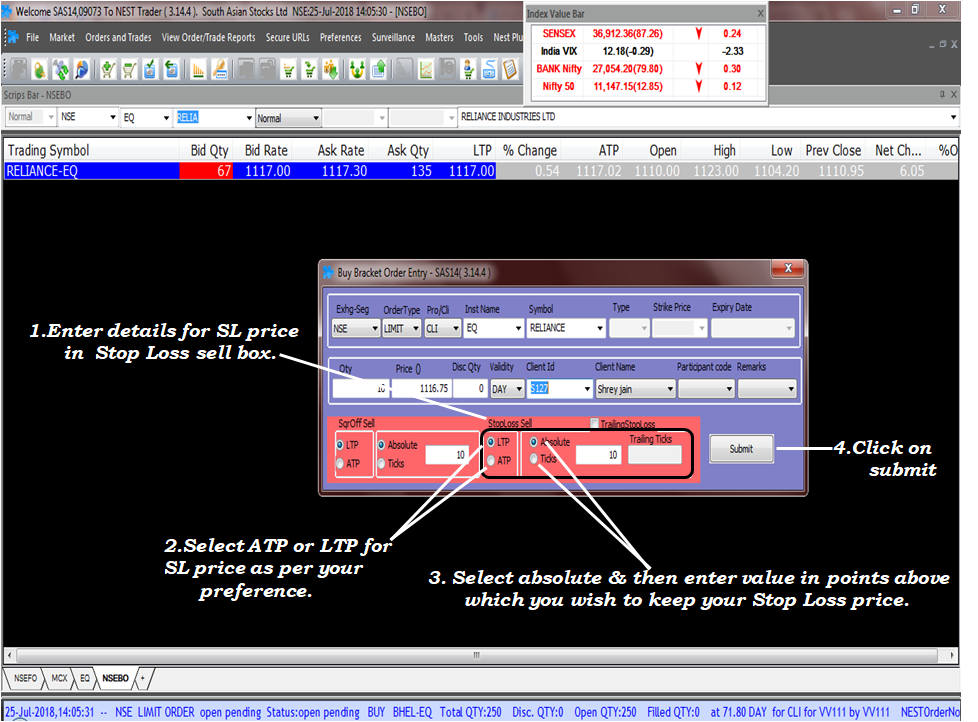

3. Place a Stop Loss Price by choosing LTP / ATP as per your preference in the third column and absolute / tick in the fourth column.

For EQ Segment

4. Click on Submit.

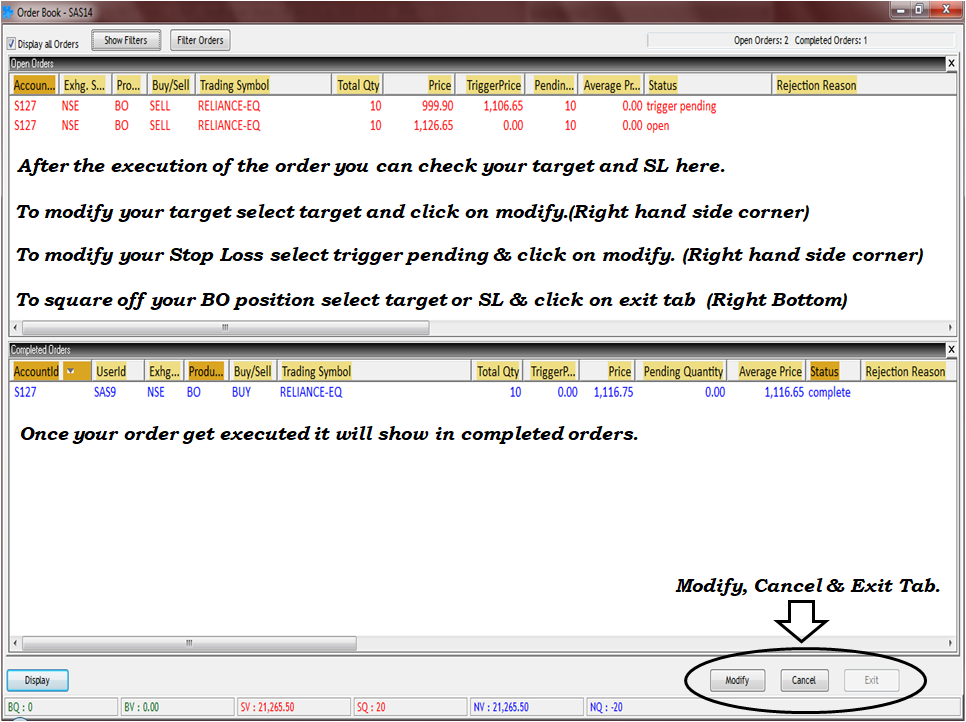

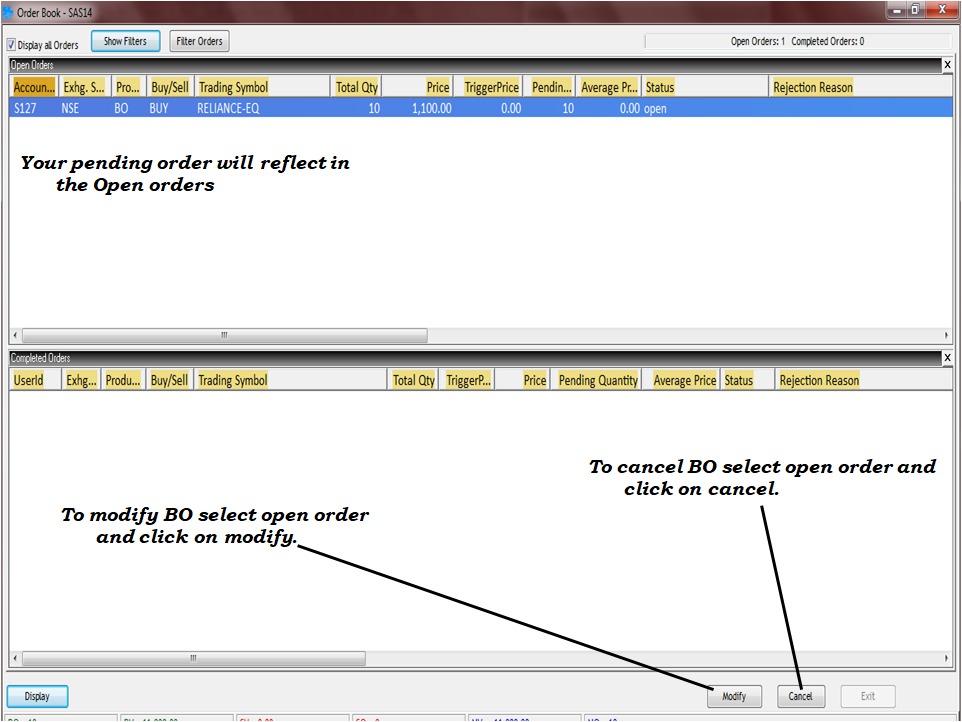

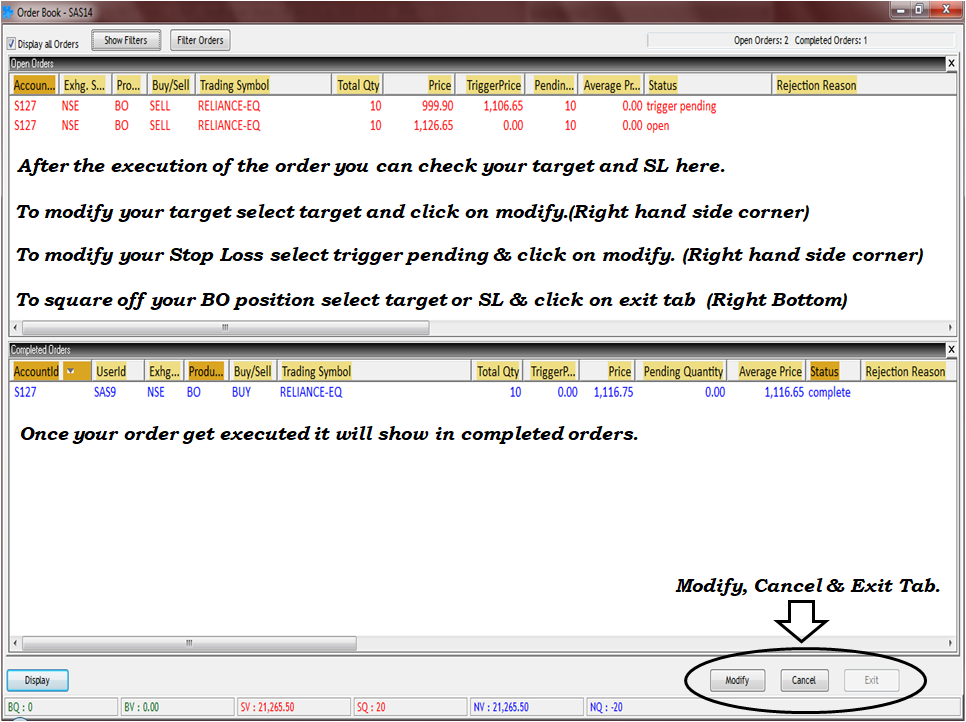

5. As soon as the order is completed at your given limit price, simultaneous Target and SL order will be placed, which can be seen in Order Book. (F3)

6. To square off Bracket order Position, open order book (F3) >> select any 1 pending order >> click on EXIT.

7. Square off order will be completed at the Market rate.

Important things to remember:

- For Margins and SL range in Futures, please refer to this Link

- For Margins & SL range in NSE Cash, please refer to this Link

- For margins available in Option buying & selling, please refer to this Link

- For Margins and SL range in MCX Futures, please refer to Link

- For Margins and SL range in Currency Futures, please refer to this Link

- For margins available in Currency Option buying & selling, please refer to this Link

- Bracket Orders are for intraday trades only. Positions taken through Bracket order cannot be converted and cannot be carried forward. All positions taken through Bracket Orders might be squared off by RMS Team at 03.20 PM (Equity),4:50 PM Currency, and 11:00 PM /11:30 PM (MCX), if not done from the client's end.

- Bracket orders are available in NSE Cash (Upto 5 Times limits), No intraday margin in FNO, CDS & MCX.

- ATP - Avg. Traded Price: If you select ATP while placing a Target / SL order, then your order will be placed as per the average rate of your completed order.

- LTP - Last Traded Price: If you select LTP while placing a Target / SL order, then your order will be placed as per the last traded price of the scrip when your order is completed.

- Absolute: While placing Target / SL Order, select Absolute and enter Target and SL in points. For eg: if Nifty is bought at 7400 and you wish to place your target @ 7420 and SL @ 7390, then in the Square off sell column enter 20, and in the Stop-loss sell column enter 10.

- Ticks: While placing Target / SL Order, select Ticks, and enter Target and SL in ticks. 1 Tick = 0.05 points, so 20 Ticks is 1 point. For e.g. - if Nifty is bought at 7400 and you wish to place your target @ 7420 and SL @ 7390, then in the Square off sell column enter 400, and in the Stop-loss sell column enter 200.

- For availing 2 times margin in options buying, you need to enter SL at a price difference of 30% from your trade rate. And for availing 5 times margin in options selling, you need to enter SL within 1% range for Index options and within 2% range for Stock Options. (1% and 2% of the underlying price).

- Also, if the order entered is completed in multiple trades, then, SL and Target orders will be placed separately for each trade and will be billed per executed order.

- Please note for clients in the Rs. 1299- monthly brokerage plan, Bracket Orders are chargeable at Rs. 12.99/- per executed order over and above the current brokerage plan.